Marcus Lindstrom/E+ through Getty Photos

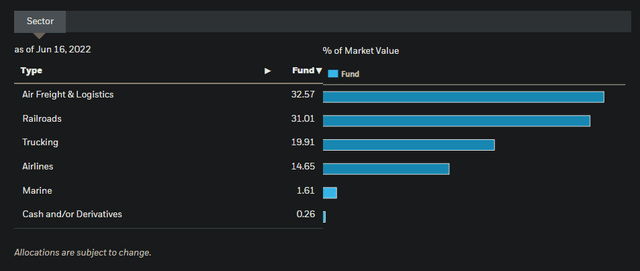

iShares US Transportation ETF (BATS:BATS:IYT) is an exchange-traded fund targeted on the transportation sector. The fund invests in listed U.S. airline, railroad and trucking firms. IYT is designed to trace the efficiency of its benchmark index, which is the S&P Transportation Choose Business FMC Capped Index. IYT had 52 holdings as of June 16, 2022, and a full sector breakdown is illustrated beneath. The expense ratio of the fund is 0.41%, and property beneath administration had been $789 million as of June 16, 2022.

iShares.com

As you possibly can see, the most important exposures are Air Freight & Logistics (33%) and Railroads (31%); additionally Trucking (20%), and Airways (15%). The fund is pretty balanced throughout completely different segments of the transportation sector. Nonetheless, IYT’s benchmark index does use a capping rule, and this turns into apparently essential whenever you look to the portfolio itself; the most important two holdings collectively characterize a full 38% of the fund.

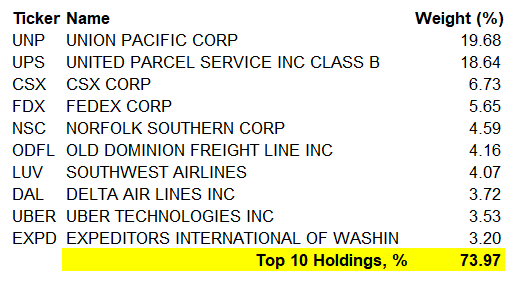

Information from iShares.com

The highest two holdings are Union Pacific Corp (UNP), a freight-hauling railroad that operates 8,300 locomotives over 32,200 miles routes in 23 U.S. states west of Chicago and New Orleans, and United Parcel Service (i.e., UPS) (UPS), an American multinational delivery & receiving and provide chain administration firm.

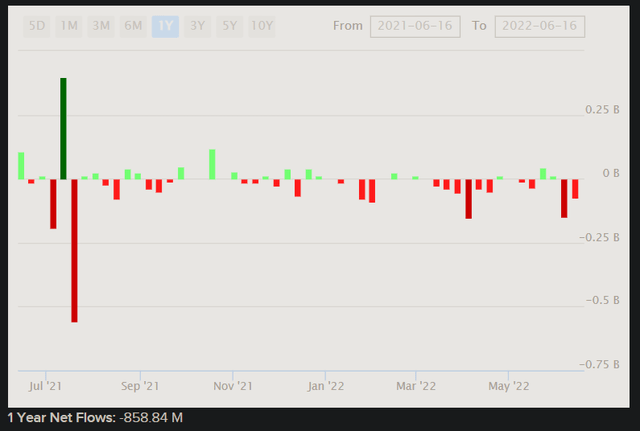

IYT has fallen roughly according to the S&P 500 U.S. fairness index this 12 months, and so we do not see any notable under- or over-performance. It’s attention-grabbing to notice individually although that IYT sometimes carries a beta of 1.18x, whereas web outflows over the previous 12 months exceed the present-day complete AUM (see beneath). Over the previous 12 months, $859 million has left the fund, leaving AUM now at $789 million, as talked about earlier.

ETFDB.com

So, property beneath administration have principally halved, whereas historic beta is definitely nearly 1.20x. With IYT roughly matching the S&P 500 index, you could possibly argue it’s holding up effectively. Up to now, we would have anticipated the sector to be doing worse. Whereas there have been loads of provide chain points attributable to a ramp in client demand publish pandemic, that very same ramp in client demand (which has additionally contributed to inflationary pressures) has been a typically constructive backdrop for transportation firms (delivery items). Now, as fears are rising of unsustainably simple financial coverage, persistent inflation, and near-term recession dangers, IYT is probably beginning to look rather a lot much less engaging.

However, IYT has fallen considerably this 12 months together with different shares (iShares report YTD efficiency on the time of writing of -24.49%). So, it’s value gauging the worth of IYT relative to cost.

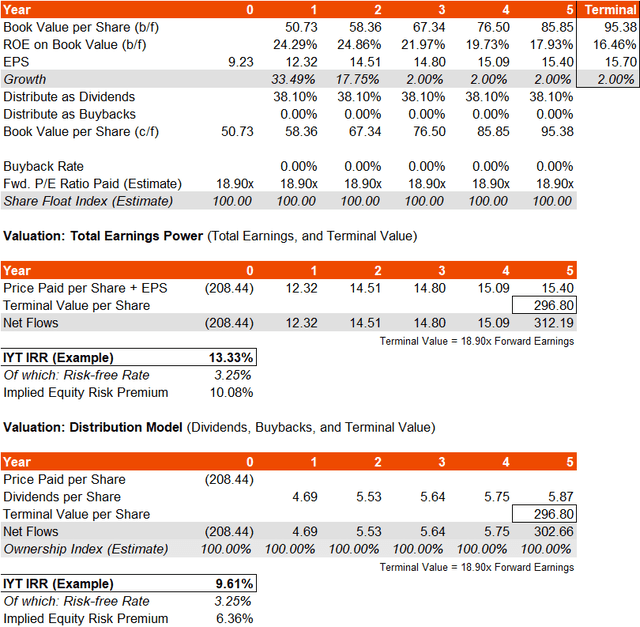

IYT’s benchmark’s most up-to-date factsheet, as of Might 31, 2022, reported trailing and ahead value/earnings 25.23x and 18.90x, respectively, with a value/e book ratio of 4.59x, and an indicative dividend yield of 1.51%. Utilizing this data, I calculate an implied ahead return on fairness of 24.29%, and a distribution price of earnings into dividends of 38.10%.

We are able to assume the ahead return on fairness might be unsustainable (we should always at the least begin by being conservative); I’d additionally observe that Morningstar‘s present three- to five-year common earnings development price is estimated at 14.46%. Given S&P Dow Jones Indices projecting ahead one-year earnings development at 33.49% (implied by the trailing and ahead value/earnings ratios), to carry our three- to five-year projection according to 14.46%, we would want a reasonably steep drop in earnings development. I’ll resolve to guess 18% in 12 months two, after which 2% thereafter (i.e., front-loaded development, adopted by steady development roughly according to inflation in the intervening time).

Retaining the dividend distribution price the identical at 38%, and assuming no buybacks, the return on fairness drops to 16% in 12 months six, and maintaining the terminal ahead value/earnings ratio fixed with right now’s, the implied IRR might be as excessive as 13% (or 9-10% if we deal with dividend distributions).

Writer’s Calculations

The ahead value/earnings ratio within the terminal 12 months is eighteen.90x within the above calculation, the identical as right now’s; the implication is a ahead earnings yield of 5.29%. That appears low, however should you think about an ERP between 4.20-5.90% (a good fairness danger premium is 4.20% to five.00%, however you could possibly alter the higher sure for IYT’s beta of 1.18x), and in addition assume a risk-free price of circa 3.25% (roughly the place the present U.S. 10-year yield is), the implied distinction is wherever from 2.16% to three.86% in long-term earnings development (implied).

Since long-term nominal inflation might be going to be nearer to 2% in the long term (to perpetuity), unlikely rather more, you possibly can see right here that IYT has some constructive skewness and suspected inflation-adjusted development potential over the longer run. Maybe the market beta for the fund will settle in the long term too. The 18.90x a number of doesn’t appear notably wealthy. Nonetheless, in 12 months 6 (our terminal 12 months), if we assumed that IYT’s portfolio was long-term development of solely 2%, the a number of ought to in idea contract to one thing extra like 16.7-17.5x. That will take our unique IRR gauge from 9.61-13.33% to a decrease potential of seven.10-11.00%; that’s nonetheless respectable, but it surely does recommend a tighter underlying fairness danger premium on the decrease finish.

On steadiness, whereas I’ve been bearish on IYT after taking initially a impartial stance, after the latest draw back I’d now be again to impartial on the fund. The fund has fallen since my final article of circa -22.01% on a complete return foundation. Now, it seems to supply fairly good worth, however not sufficient to make the fund appear safely undervalued. Additionally, it’s doable that earnings estimates are exaggerated; whereas my notional estimates could be seen as conservative in some areas, we are able to additionally assume that fairness danger premiums will broaden for IYT ought to there be a recession or a collection of damaging earnings surprises throughout the portfolio (which is itself naturally concentrated).