Jerritt Clark/Getty Photographs Leisure

I do not fancy myself a fan of retail corporations, significantly these that concentrate on clothes. This is because of low margins and excessive ranges of competitors. Even so, in latest months, one agency that has performed effectively in comparison with the broader market is Vacation spot XL Group (NASDAQ:DXLG). Administration succeeded in ending the 2021 fiscal yr with a bang and, now that we’re into the 2022 fiscal yr, the corporate expects gross sales to proceed rising. Having stated that, regardless of experiencing some enchancment on its backside line, the corporate is now forecasting that its profitability for the present fiscal yr is likely to be decrease than it was final yr. Add on to this the structural issues the corporate has, and I’ve determined to lastly downgrade the corporate from a ‘purchase’ to a ‘maintain’.

A distinct segment clothes agency

In March of this yr, I wrote an article about Vacation spot XL Group. In that article, I acknowledged the corporate’s combined working historical past. Pushed largely by a continued decline in retailer rely, I stated that the long-term pattern for the corporate was not constructive. Nevertheless, I discovered myself proud of the low buying and selling worth of the enterprise and the truth that it had money in extra of debt. This indicated to me that the near-term danger for shareholders was restricted, regardless that the long-term outlook for the corporate was something however favorable. At the moment, I had rated the enterprise a ‘purchase’, however I did warn that buyers shouldn’t be within the firm for too lengthy. Since then, Vacation spot XL Group has carried out higher than I anticipated. Whereas the S&P 500 is down by 9.1%, shares of this retailer have decreased in worth by 6.4%.

Writer – SEC EDGAR Information

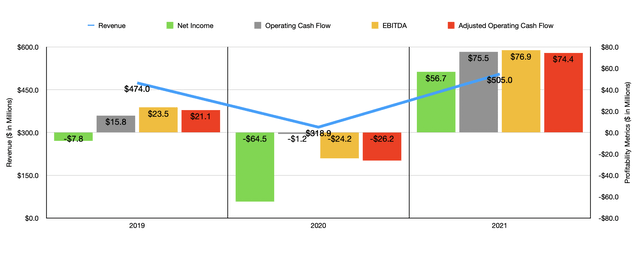

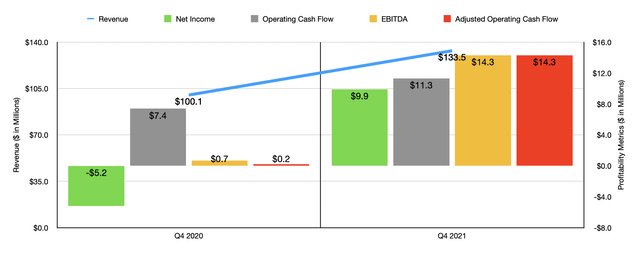

This disparity in comparison with the broader market was not with out trigger. The very fact of the matter is that the enterprise has been producing some quite sturdy monetary figures as of late. Contemplate income. Once I final wrote concerning the agency, I solely had information protecting by the third quarter of the corporate’s 2021 fiscal yr. Immediately, I now have information protecting by the first quarter of 2022. To finish out the 2021 fiscal yr, administration reported income of $133.5 million. That is 33.4% greater than the $100.1 million generated the identical time one yr earlier. Administration attributed this important enchancment to a 41.5% rise in comparable gross sales, virtually definitely as a result of reopening of the economic system following the tip of the COVID-19 pandemic. Because of this sturdy ultimate quarter, income for 2021 as an entire got here in at $505 million. That is 58.4% above the $318.9 million generated within the 2020 fiscal yr. It is also 6.5% greater than the $474 million reported for the 2019 fiscal yr.

Writer – SEC EDGAR Information

As income elevated, so too did profitability. Internet earnings within the ultimate quarter was $9.9 million. That compares to the $5.1 million loss generated one yr earlier. This introduced whole internet earnings for the 2021 fiscal yr to $56.7 million. That is truly the best in earnings the corporate has generated in no less than 5 years. Different profitability metrics adopted go well with. Working money movement within the ultimate quarter was $11.3 million. That stacks up towards the $7.4 million generated within the ultimate quarter of 2020. On an adjusted foundation, this metric rose from $0.2 million to $14.3 million, whereas EBITDA expanded from $0.7 million to $14.3 million. Because the chart above illustrates, this additionally meant stronger efficiency throughout all classes in comparison with each 2020 and 2019.

Writer – SEC EDGAR Information

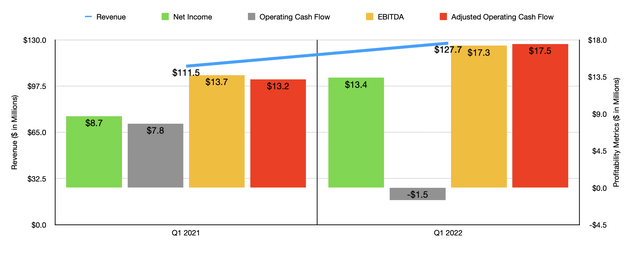

Now, we’ve much more information. Within the first quarter of 2022, administration continued to extend gross sales, with income of $127.7 million coming in 14.5% above the $111.5 million generated within the first quarter of 2021. Internet earnings rose from $8.7 million to $13.4 million. Working money movement did worsen, dropping from $7.8 million to unfavorable $1.5 million. But when we alter for modifications in working capital, it could have risen from $13.2 million to $17.5 million. An analogous improve may be seen when taking a look at EBITDA. It in the end rose from $13.7 million within the first quarter of 2021 to $17.3 million the identical time this yr. In relation to the 2022 fiscal yr, administration does imagine that income ought to are available in at between $510 million and $530 million. Though this represents a rise in comparison with what the enterprise achieved in 2021, they do suppose that EBITDA is likely to be someplace round $52 million. That represents a considerable decline in comparison with what the enterprise generated in its 2021 fiscal yr. If we assume that working money movement will comply with go well with, then that metric ought to are available in at round $50.3 million for the yr.

Though monetary efficiency for the corporate has been wanting up, the agency does have some structural issues. The true massive concern is that administration continues to shut down shops. Immediately, the corporate generates about 31% of its income from direct-to-consumer actions that largely relate to its on-line gross sales. That is a pleasant chunk, however nothing ought to distract from the truth that the corporate solely has 286 shops in operation right now. For the 2021 fiscal yr, it had 290 shops in operation. In 2020, this quantity was 311. And again in 2016, this quantity was 343. Clearly, the enterprise is affected by a declining footprint. And except we see its on-line gross sales improve additional, there might be some long-term ache for the corporate. That is additionally why I discovered myself unenthused when administration introduced, on March fifteenth of this yr, its resolution to authorize a $15 million share buyback program. As a substitute of shopping for again inventory, administration needs to be targeted on enhancing the corporate’s high and backside strains.

Writer – SEC EDGAR Information

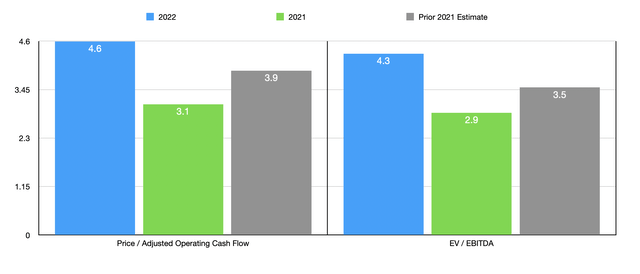

Clearly, Vacation spot XL Group has some long-term points. However what drove me to price the corporate a ‘purchase’ was how low cost shares had been. Utilizing the information from 2021, the agency is buying and selling at a worth to adjusted working money movement a number of of three.1. And the EV to EBITDA a number of needs to be 2.9. If we use the 2022 estimates, these numbers improve to 4.6 and to 4.3. To place this in perspective, I made a decision to match the corporate to 5 related companies. On a worth to working money movement foundation, these corporations ranged from a low of three to a excessive of 23.3. Utilizing our extra conservative 2022 estimates, we are able to see that two of the 5 corporations are cheaper than Vacation spot XL Group. In the meantime, utilizing the EV to EBITDA strategy, the vary is from 1.3 to five.7. On this case, three of the 5 corporations are cheaper than our prospect.

| Firm | Value / Working Money Movement | EV / EBITDA |

| Vacation spot XL Group | 4.6 | 4.3 |

| Citi Tendencies (CTRN) | 3.4 | 1.5 |

| Categorical (EXPR) | 9.8 | 3.3 |

| J.Jill (JILL) | 3.0 | 5.7 |

| Tilly’s (TLYS) | 8.8 | 1.3 |

| Tandy Leather-based Manufacturing facility (OTCPK:TLFA) | 23.3 | 5.0 |

Takeaway

In most respects, Vacation spot XL Group appears to be like to be buying and selling on a budget and monetary efficiency lately has been spectacular. Transferring ahead, income ought to climb additional. But it surely appears to be like as if profitability will take one thing of a beating this yr. As a value-oriented investor who likes to be conservative together with his investments, I would like to err on the aspect of warning. Long run, the corporate doesn’t look all that nice and I’m significantly discouraged with what the remainder of this yr may appear to be. So due to that, I’ve determined to downgrade the enterprise from a ‘purchase’ to a ‘maintain’.